Table of Contents

Did Banks Encourage Capitalists to Save Money? Yes, Banks play a very important role in our lives, especially for people who own businesses, known as capitalists. They provide a safe place to store money and offer ways to grow that money over time. In Pakistan, banks encourage capitalists to save their money by offering different accounts and investment options.

Overview of Banks in Pakistan

Banks in Pakistan provide many services to both regular people and business owners. These services include savings accounts, loans, and investments. Banks also offer advice on how to manage money wisely. Some of the top banks in Pakistan include National Bank of Pakistan (NBP), Habib Bank Limited (HBL), and Meezan Bank (an Islamic bank).

How Banks Help Capitalists Save:

- Savings Accounts: These accounts keep your money safe and help it grow by paying interest.

- Investment Plans: Banks offer plans like mutual funds and bonds that can help capitalists grow their money.

- Financial Advice: Banks also guide capitalists on how to invest and save for the future.

Understanding Capitalism and Savings

Capitalism is a system where businesses and individuals try to make a profit. Capitalists are the people who invest in businesses to make money. For capitalists, saving is important because it helps them grow their wealth and provides funds for future business opportunities.

Why Savings Matter for Capitalists:

- Business Growth: Savings can be used to expand the business or buy new equipment.

- Emergency Funds: In case of unexpected problems, having money saved is helpful.

- Investments: Saved money can be invested in stocks, bonds, or other businesses to grow even more.

The Role of Banks in Encouraging Capitalists to Save

Banks help capitalists save money and make their savings grow. They do this by offering special accounts and investment plans. Let’s see how banks encourage capitalists to save:

How Banks Promote Saving in Pakistan

Banks in Pakistan have many ways to help people save their money:

- High-Interest Savings Accounts: Banks offer savings accounts that pay interest. This means that the money you keep in the bank grows over time because the bank adds extra money (interest) to your account.

- Investment Plans: Banks provide investment options like mutual funds and bonds. These investments can help capitalists earn more money by using their savings to buy shares or lend money.

- Regular Statements and Updates: Banks send regular updates about your savings and investments. This helps capitalists see how their money is growing and encourages them to keep saving.

- Promotional Offers: Sometimes, banks have special offers, like higher interest rates or bonuses for opening new accounts or investing a certain amount of money.

Key Banking Services for Capitalists

Banks offer several important services that help capitalists save and manage their money:

- Savings Accounts: These are basic accounts where capitalists can deposit their money. The bank pays interest on the money kept in the account. It’s a safe way to save.

- Fixed Deposit Accounts: In these accounts, capitalists put their money in the bank for a fixed period (like 1 year). The bank pays higher interest for keeping the money locked away for that time.

- Mutual Funds: Banks collect money from many investors and use it to buy stocks, bonds, or other investments. This helps capitalists grow their money over time.

- Bonds: Banks offer bonds, which are like loans you give to the government or a company. In return, they pay you interest until the bond matures (ends).

- Islamic Banking: For those who follow Islamic finance rules, banks offer special accounts and investment options that comply with Islamic laws, which do not involve earning interest.

- Financial Advice: Banks provide expert advice on how to manage and invest money wisely. This helps capitalists make informed decisions about their savings and investments.

Savings Accounts for Capitalists

Savings Accounts are a great way for capitalists to keep their money safe and make it grow over time. Banks offer different types of savings accounts with various features to help capitalists manage their money.

| Account Type | Interest Rate | Minimum Deposit | Key Benefits |

|---|---|---|---|

| Basic Savings Account | 5% | PKR 1,000 | Safe and easy savings |

| Fixed Deposit Account | 7-10% | PKR 10,000 | Higher returns over time |

Types of Savings Accounts in Pakistan

- Basic Savings Accounts:

- Description: Simple accounts where you can deposit money and earn interest.

- Key Features: Easy to open, usually no minimum balance requirement.

- Fixed Deposit Accounts:

- Description: You deposit a set amount of money for a fixed period (like 1 year) and cannot withdraw it until the period ends.

- Key Features: Higher interest rates compared to basic savings accounts.

- High-Yield Savings Accounts:

- Description: Special accounts that offer higher interest rates to help your money grow faster.

- Key Features: May require a higher minimum balance or certain conditions to be met.

- Islamic Savings Accounts:

- Description: Accounts that follow Islamic banking rules, which do not involve earning interest.

- Key Features: Complies with Shariah law, provides profit-sharing instead of interest.

Interest Rates Offered by Banks

Banks offer different interest rates on savings accounts. Here’s a simple way to understand how interest rates work:

- Basic Savings Accounts: Typically offer lower interest rates. For example, 4-6% per year.

- Fixed Deposit Accounts: Usually offer higher interest rates because you agree to keep your money in the account for a set period. Rates can be 6-9% per year.

- High-Yield Savings Accounts: Provide the highest interest rates among savings accounts, which can be 7-12% per year.

Interest Rate Example: If you have PKR 10,000 in a savings account with a 5% interest rate, you will earn PKR 500 over one year.

Benefits of High-Interest Savings Accounts

High-interest savings accounts have several benefits:

- More Earnings: The higher the interest rate, the more money you earn on your savings. For example, if you have PKR 10,000 in an account with a 10% interest rate, you would earn PKR 1,000 in one year.

- Better Growth: High-interest accounts help your savings grow faster compared to basic accounts. This is great for capitalists who want to maximize their money.

- Incentives for Saving: Banks may offer additional perks, like bonuses or higher rates for large deposits or long-term commitments.

- Encourages Saving: Higher interest rates encourage people to save more money because they see their savings growing more quickly.

Investment Options Offered by Banks

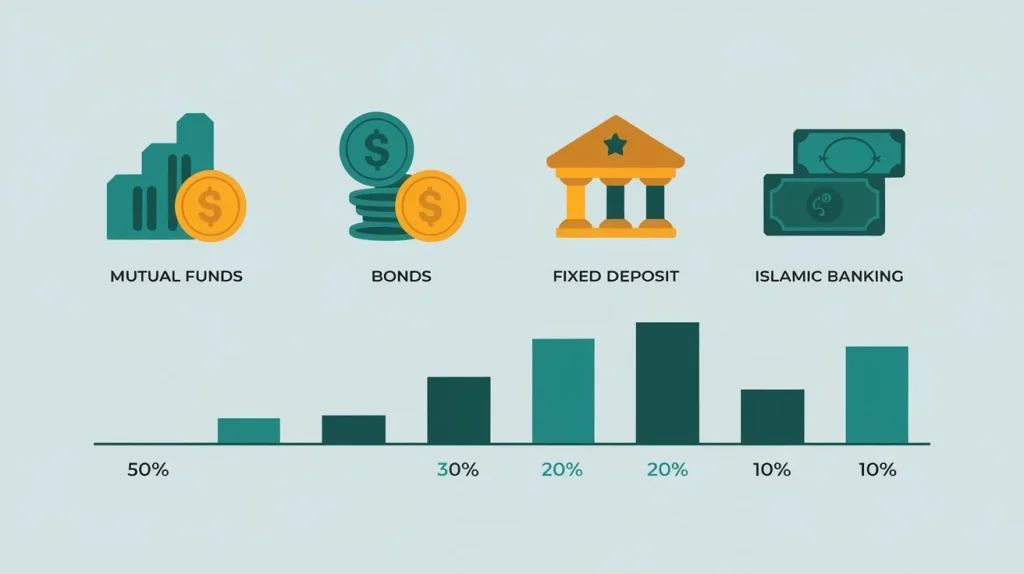

Banks offer various ways to invest money and help it grow. Here are some of the leading asset opportunities available:

| Investment Option | Risk Level | Expected Return | Duration |

|---|---|---|---|

| Mutual Funds | Moderate | 8-12% | Long-term (3+ years) |

| Bonds | Low | 5-7% | Fixed (2-5 years) |

| Fixed Deposit Accounts | Low | 7-10% | Fixed (1-3 years) |

| Islamic Investments | Low-Moderate | Variable | Long-term (3+ years) |

Mutual Funds

- What They Are: Mutual funds collect money from many people and invest it in different things, like stocks or bonds. It’s like a big pot where everyone puts in their money, and the bank uses it to buy investments.

- How They Work: You buy shares in the mutual fund, and the bank’s experts manage the money. They make decisions about where to invest to try to earn more money.

- Benefits:

- Diversification: Your money is spread out across different investments, reducing risk.

- Expert Management: Professionals handle the investments for you.

- Accessibility: You can start with a small amount of money.

Bonds

- What They Are: Bonds are like loans you give to the government or a company. In return, they promise to pay you interest for a certain period and return your money at the end of the term.

- How They Work: When you buy a bond, you are lending money. The bond issuer pays you interest regularly (like a paycheck) and returns the original amount when the bond matures.

- Benefits:

- Stable Returns: Bonds generally offer fixed interest payments.

- Lower Risk: They are usually safer than stocks.

- Predictable Income: You know how much you will earn in interest.

Fixed Deposit Accounts

- What They Are: Fixed deposit accounts let you deposit a set amount of money for a specific time period. You can’t access this money until the period ends, but you earn a higher interest rate.

- How They Work: You choose how long you want to keep your money in the account (like 1 year or 2 years). The bank pays you a higher interest rate because you agree to keep your money there for that time.

- Benefits:

- Higher Interest Rates: You earn more interest compared to regular savings accounts.

- Safety: Your money is safe and secure in the account.

- Secured Returns: You know precisely how much interest you will gain.

Islamic Banking and Shariah-Compliant Investments

- What They Are: Islamic Banking follows Islamic law, which means it doesn’t involve earning or paying interest. Instead, it uses profit-sharing and other methods that comply with Shariah.

- How They Work: Instead of earning interest, you share in the profits of the investments. For example, in a Mudarabah (profit-sharing) arrangement, the bank invests your money and shares the profits with you.

- Benefits:

- Compliance with Islamic Law: Follows principles of Shariah, avoiding interest.

- Profit Sharing: You earn a share of the profits rather than fixed interest.

- Ethical Investments: Investments are in businesses and activities that are considered ethical and lawful.

Did Banks Encourage Capitalists to Save Money?

Yes, banks play a big role in encouraging capitalists to save money. They do this by offering different types of savings accounts and investment options that help grow money over time. Banks provide a safe place for capitalists to keep their money and make it work for them through interest and investments.

Historical Perspective of Banking in Pakistan

- Early Banking: In the past, banks in Pakistan were simple and mostly helped people with basic savings accounts. They provided a safe place to keep money but offered few ways to grow it.

- Development Over Time: As the banking industry grew, banks started offering more services like fixed deposits, bonds, and mutual funds. This helped capitalists not just keep their money safe but also grow it.

- Modern Banking: Today, banks in Pakistan offer a wide range of savings and investment options. They have made saving and investing easier for capitalists with advanced services and technology.

Policies and Reforms That Encourage Saving

- Interest Rates: Banks offer competitive interest rates on savings accounts and fixed deposits. Higher rates mean more money earned on savings.

- Incentives for Saving: Some banks give bonuses or extra benefits for opening new accounts or investing a certain amount of money.

- Government Schemes: The government has introduced various schemes to encourage saving. These include special savings plans with tax benefits and higher interest rates.

- Financial Education: Banks provide resources and advice to help people understand the importance of saving and investing. This education helps capitalists make informed decisions.

The Role of State Bank of Pakistan

- Regulation: The State Bank of Pakistan (SBP) is the central bank that oversees all banks in the country. It sets rules to ensure banks operate safely and fairly.

- Encouraging Savings: The SBP sets guidelines for interest rates and promotes savings schemes that benefit both regular people and capitalists.

- Monetary Policy: The SBP manages the country’s money supply and interest rates. By controlling these factors, the SBP helps create a stable environment for saving and investing.

- Financial Inclusion: The SBP works to make banking services available to more people, including those in remote areas. This helps more capitalists access banking services and encourages saving.

Why Capitalists Need to Save Money

Capitalists need to save money for several important reasons:

Importance of Savings for Business Growth

- Investing in New Projects: Saving money allows capitalists to invest in new projects or expand their businesses. This could mean buying new equipment or opening new locations.

- Improving Operations: Savings can be used to upgrade technology or improve business processes, which helps in making the business more efficient and profitable.

- Staying Competitive: By saving and investing wisely, capitalists can stay ahead of their competitors and adapt to changes in the market.

Emergency Funds for Businesses

- Handling Unexpected Costs: Having an emergency fund helps cover unexpected costs like equipment breakdowns or sudden increases in expenses. It ensures that the business can keep running smoothly even in tough times.

- Avoiding Debt: With an emergency fund, capitalists don’t need to borrow money or take on debt when unexpected expenses arise. This keeps the business financially healthy.

- Peace of Mind: Knowing there is money set aside for emergencies provides peace of mind and reduces stress about financial problems.

Opportunities for Investment and Expansion

- Growing the Business: Savings provide the capital needed to explore new opportunities, like entering new markets or launching new products. This can direct to more clients and increase revenue.

- Buying Other Businesses: Capitalists can use their savings to buy other companies, which can help their business grow faster and become more successful.

- Investing in Technology: Savings allow capitalists to invest in the latest technology, which can improve efficiency and create a competitive advantage.

How Banks Provide Financial Guidance to Capitalists

Banks offer various ways to help capitalists manage their money and make smart investment decisions. Here’s how they do it:

Advisory Services Offered by Banks

- Expert Advice: Banks have financial experts who provide advice on managing money and making investments. These experts help capitalists understand their options and choose the best ones.

- Investment Strategies: Banks offer guidance on different investment strategies, such as which stocks or bonds to buy. They help capitalists decide where to put their money to get the best returns.

- Financial Planning: Banks help create plans for saving and investing. They look at the capitalists’ financial goals and suggest ways to achieve them.

Personalized Financial Plans

- Custom Plans: Banks create financial plans tailored to each capitalist’s needs. This means the plan is designed just for them based on their money goals and how much they want to save or invest.

- Setting Goals: Personalized plans help capitalists set specific goals, like saving for a new business or expanding an existing one. The plan shows how much money they need and how to save it.

- Regular Reviews: Banks regularly review and update these plans to make sure they still fit the capitalist’s goals and any changes in their financial situation.

How Banks Help Capitalists Make Investment Decisions

- Research and Information: Banks provide research and information about different investments, like mutual funds or stocks. This helps capitalists make informed choices.

- Risk Assessment: Banks help evaluate the risks of different investments. They explain what might happen if an investment does well or poorly, so capitalists can decide what they’re comfortable with.

- Monitoring Investments: Banks keep track of investments and provide updates on their performance. They help capitalists understand how their money is growing and if any changes are needed.

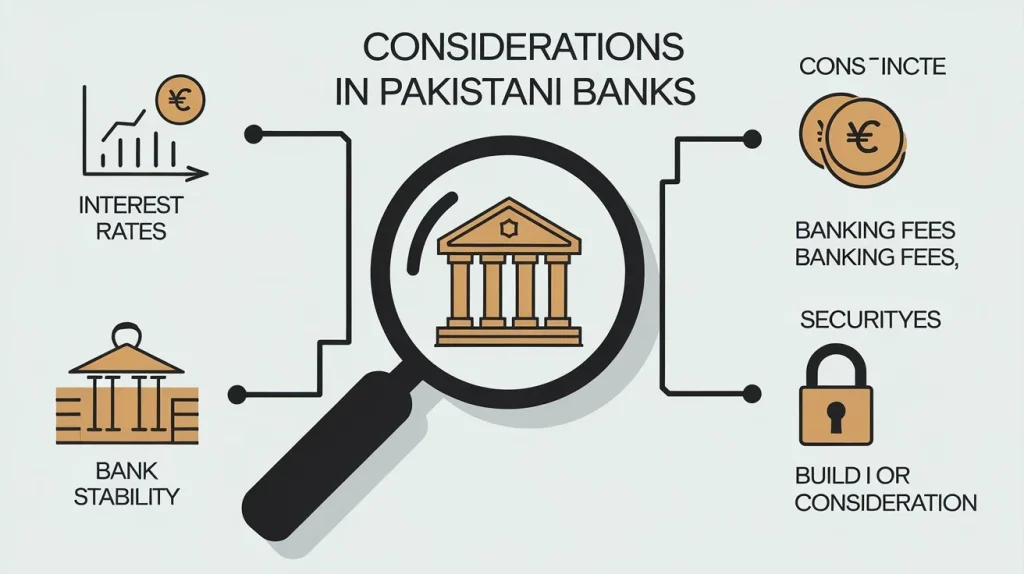

Things to Consider Before Investing in Pakistani Banks

Before putting your money into a bank in Pakistan, it’s important to think about a few key things to make sure your investment is safe and smart. Here’s what you need to know:

| Bank | Interest Rate | Fees | Reputation |

|---|---|---|---|

| National Bank of Pakistan (NBP) | 6% | Low | Government-backed |

| Habib Bank Limited (HBL) | 7% | Moderate | High reputation |

| United Bank Limited (UBL) | 6.5% | Moderate | Strong reputation |

Interest Rates and Returns on Savings

- What Are Interest Rates?: Interest rates are the extra money banks pay you for keeping your money in their accounts. Higher rates mean you earn more money.

- Compare Rates: Different banks offer different interest rates. Check and compare rates before choosing a bank to make sure you get the best deal.

- Returns on Savings: Look at how much money you will earn from your savings. For example, if you save PKR 10,000 at an interest rate of 5%, you will earn PKR 500 in a year.

Banking Fees and Hidden Charges

- Account Fees: Some banks charge fees for having an account. These can include monthly maintenance fees or charges for certain transactions. Check what fees apply to your account.

- Hidden Charges: Be aware of any hidden charges that might not be obvious at first. These could include fees for withdrawing money, transferring funds, or closing the account.

- Ask Questions: Before opening an account, ask the bank about any fees or charges so there are no surprises later.

Stability and Reputation of Banks

- Bank Stability: Choose a bank that is financially stable and reliable. This means the bank is strong and secure enough to protect your money.

- Bank Reputation: Look at what other people say about the bank. A bank with a good reputation is more likely to be trustworthy and provide good service.

- Check Reviews: Read reviews or ask others about their experiences with the bank to make sure it is a good choice.

Security of Capital and Risk Management

- Safety of Your Money: Make sure the bank has strong security measures to protect your money. This includes secure online banking and safe storage of funds.

- Risk Management: Banks should have plans to handle risks and protect your money in case of unexpected events. Check if the bank has a good system in place to manage these risks.

- Insurance: Some banks offer insurance for your deposits, which means even if something goes wrong, you might still get your money back.

Top Banks in Pakistan for Capitalists

| Bank | Overview | Services for Capitalists | Why Choose This Bank |

|---|---|---|---|

| National Bank of Pakistan (NBP) | One of the largest banks with a strong national presence. | – Savings Accounts: Various accounts with competitive interest rates. – Investment Options: Fixed deposits, bonds, mutual funds. – Business Solutions: Loans, trade financing. | – Wide Network: Many branches and ATMs. – Reputation: Known for stability and reliability. |

| Habib Bank Limited (HBL) | Well-established bank with a global presence. | – Savings and Current Accounts: Attractive interest rates. – Investment Services: Mutual funds, bonds, portfolio management. – Business Banking: Financing and investment solutions. | – Global Reach: International presence. – Innovative Services: Advanced banking solutions and technology. |

| United Bank Limited (UBL) | Known for diverse products and strong customer service. | – Savings Accounts: Competitive rates and flexible terms. – Investment Products: Fixed deposits, mutual funds, bonds. – Business Services: Loans, trade finance, investment advisory. | – Customer Service: Excellent service focus. – Range of Products: Comprehensive banking and investment options. |

| Meezan Bank (Islamic Banking) | Leading Islamic bank with Shariah-compliant services. | – Islamic Savings Accounts: Profit-sharing instead of interest. – Islamic Investment Products: Bonds, mutual funds, profit-sharing accounts. – Business Financing: Shariah-compliant solutions. | – Shariah Compliance: Adheres to Islamic finance principles. – Specialized Services: Focus on Islamic banking. |

Summing Up: Did Banks Encourage Capitalists to Save?

Banks play a crucial role in encouraging capitalists to save money. They offer various savings accounts with different interest rates, helping capitalists earn interest on their savings. Additionally, banks provide investment options like mutual funds, bonds, and fixed deposits to help grow wealth. Expert advice and personalized financial planning further support capitalists in making smart saving and investing decisions. Banks also ensure security and stability for deposits, protecting customers’ money. For those seeking Shariah-compliant options, banks such as Meezan Bank offer specialized Islamic banking services.