Table of Contents

Best Way to Save Money for a House in 2024 is within your reach! Buying a house is a big dream for many people, and saving money for it can seem overwhelming. But don’t worry! In this guide, we’ll walk you through the best way to save money for a house in 2024 with easy steps and tips that anyone can follow.

Why Saving for a House is Important?

Saving money for a house is a big deal. You need to save enough money for something called a down payment. This is the first amount of money you pay when you buy a house. It’s usually around 10% to 20% of the house’s price. If you don’t save enough, it will be hard to buy a home.

Key Challenges for Buyers

- Rising home prices: Houses can be expensive, making it harder to save enough for a down payment.

- High living costs: Everyday expenses like rent, groceries, and utilities can reduce the amount you can save.

- Unexpected expenses: Car repairs, medical bills, or other emergencies can eat into your savings.

- Debt payments: Student loans, credit cards, or other debts may limit how much you can put aside for a house.

- Low savings rates: Some savings accounts offer low interest, slowing down your progress.

- Limited income: Earning a fixed or lower income can make saving feel slower.

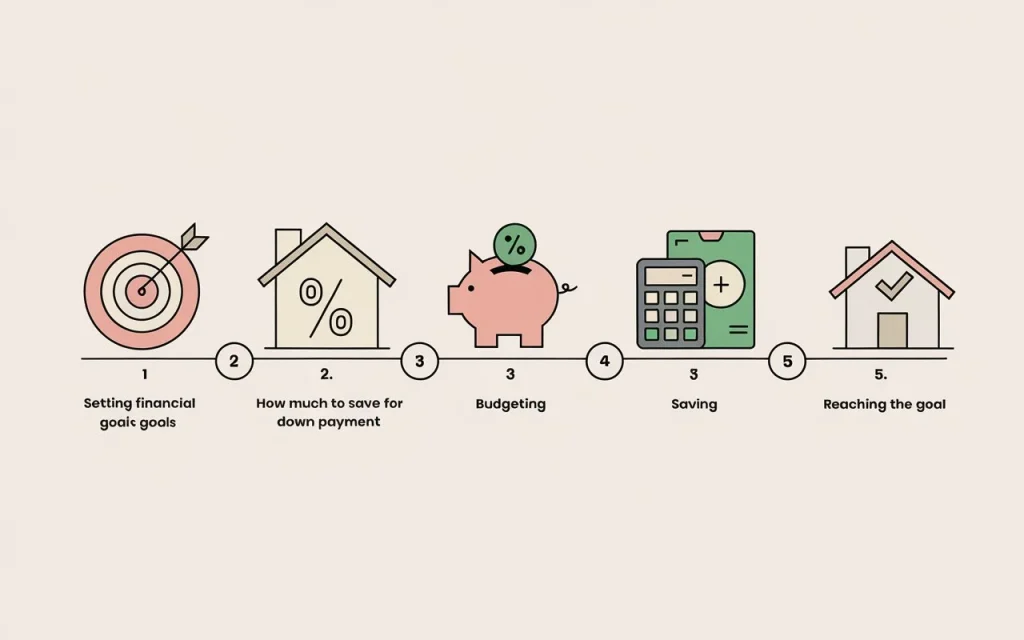

Best Way to Save Money for a House – Step-by-Step Guide

Setting Financial Goals

Start by deciding how much money you need. This includes the down payment, closing costs, and any extra money for moving and repairs.

How Much to Save for a Down Payment

For a $300,000 residence, a 10% down price is $30,000. A 20% down payment is $60,000. Figure out what works for you based on your budget and savings.

- Set clear financial goals: Know how much you need for a down payment, closing costs, and other home expenses.

- Calculate how much to save: For example, if the house costs $300,000, aim for 10% ($30,000) or 20% ($60,000) for a down payment.

- Create a budget: Track your income and expenses. Cut down on unnecessary spending like eating out or entertainment.

- Automate savings: Set up automatic transfers to a dedicated savings account every month.

- Look for ways to earn extra: Consider side jobs or freelancing to boost your savings.

- Monitor your progress: Use budgeting apps to track how close you are to your savings goal.

Building a Savings Plan

To successfully save for a house, you need a solid plan that helps you manage your money. A savings plan outlines how much you need to save and where your money should go. It’s all about being consistent and disciplined with your finances, so you can reach your goal without feeling overwhelmed. Here are some simple steps to build your savings plan:

Steps to Build Your Savings Plan:

- Set a clear goal: Decide how much you need for your down payment and when you want to buy the house.

- Create a budget: Track your income and expenses to see where you can cut costs and save more.

- Reduce unnecessary spending: Cut back on things like dining out, entertainment, and shopping for non-essentials.

- Automate your conserving: Set up automated transfers from your earnings to a trustworthy savings account.

- Track your progress: Regularly check how much you’ve saved and adjust your plan if needed.

- Review and adjust: As your income or expenses change, update your savings plan to stay on track.

Best Savings Accounts in 2024

When saving for a house, it’s important to choose the right kind of savings account to grow your money. Two of the best options are high-yield savings accounts and money market accounts. Both of these offer higher interest rates than regular savings accounts, helping your savings grow faster over time.

High-Yield Savings vs. Money Market Accounts:

- High-Yield Savings Accounts: These accounts offer better interest rates than traditional savings accounts. They’re great for earning more on your money while keeping it safe. You can easily access your funds, but there may be a limit on how many withdrawals you can make each month.

- Money Market Accounts: Similar to high-yield savings, money market accounts offer competitive interest rates. Some money market accounts come with check-writing abilities and debit card access, making them a flexible option for saving.

Choosing the Right Option:

- Interest rates: Look for reserves with the most elevated interest rates to maximize your returns.

- Fees: Make sure the account doesn’t charge monthly fees that could eat into your savings.

- Access to funds: Consider how easy it is to withdraw your money if you need it, and if there are any withdrawal limits.

- Minimum credit conditions: Some accounts require the lowest balance to earn interest or avoid expenses. Pick one that fits your conserving habits.

By picking the right account, you can make the most out of your savings and get closer to buying your dream home.

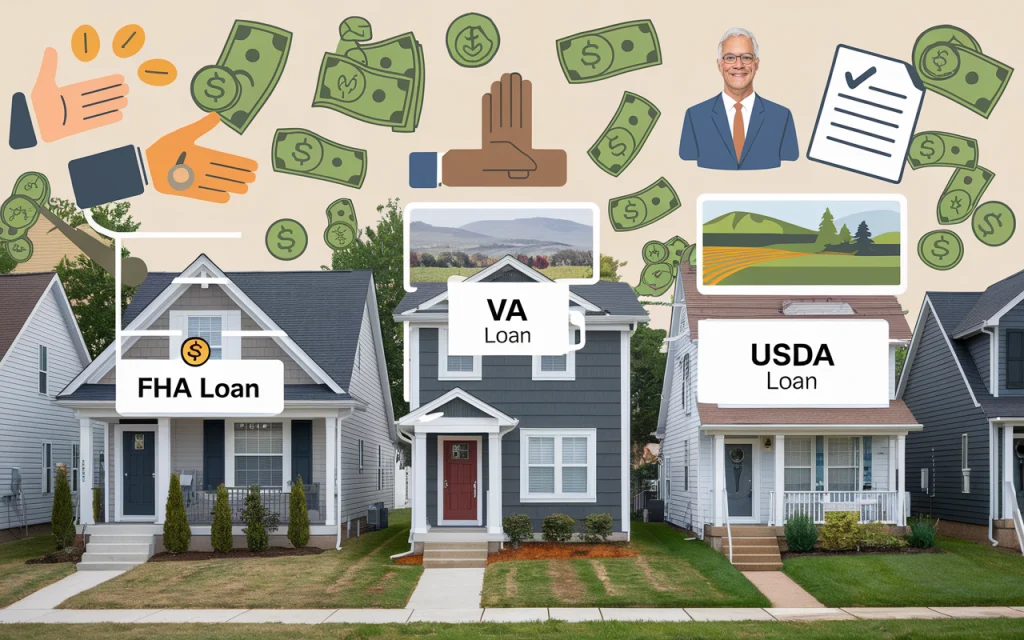

Government Assistance for Homebuyers

If you’re saving for a house, it’s important to know about the various government programs that can help make homeownership more affordable. These programs provide options for people with different financial situations, and they can be a great way to lower your costs when buying a home.

FHA, VA, and USDA Loans:

- FHA Loans: These loans are developed for first-time homebuyers. They let you make a down cost as low as 3.5%, assembling it easier to buy a home even if you don’t have a lot of savings. FHA loans also have more lenient credit requirements.

- VA Loans: If you’re a veteran, active service member, or a qualified family member, you may be eligible for a VA loan. These loans don’t require a down payment and often have better terms, such as lower interest rates.

- USDA Loans: USDA loans are for people looking to buy homes in rural areas. They offer low or even zero down payment options and are a great choice if you want to live outside of the city.

Down Payment Assistance Programs:

- There are many down payment assistance programs available, which can help cover part of your down payment. These programs vary by location, so it’s important to check local resources or government websites to see what’s available in your area.

- Some programs offer grants that don’t need to be paid back, while others provide low-interest loans to help with the down payment.

These government programs can significantly reduce the financial burden of buying a home, making it more accessible for many people. Make sure to explore your options and see which one works best for your situation!

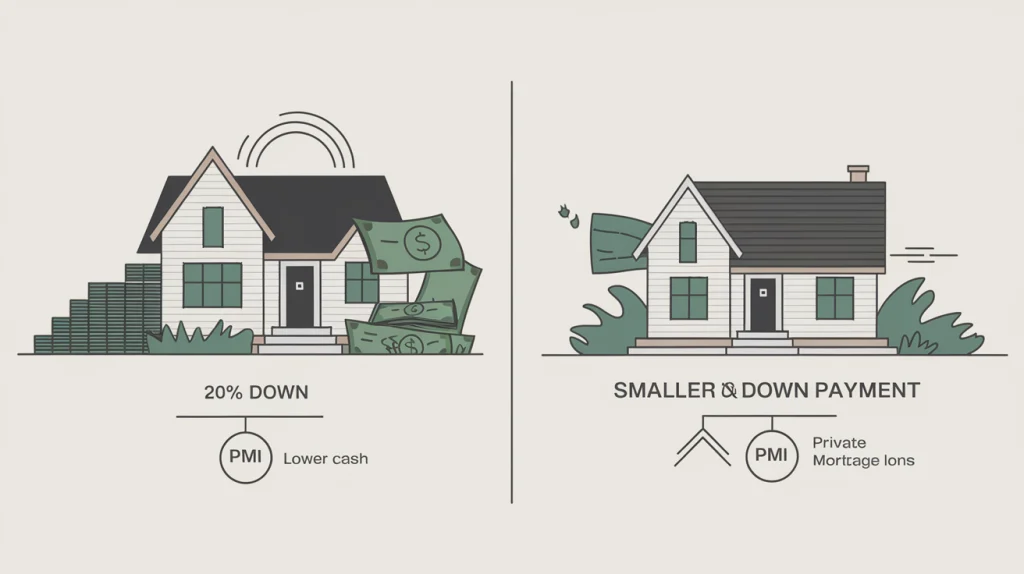

How to Decide on a Down Payment

When you’re saving for a house, one of the biggest decisions you’ll need to make is how much to put down as a down payment. The down payment is a percentage of the home’s price that you pay upfront, and it can affect your mortgage in many ways.

Pros and Cons of 20% Down:

- Pros:

- Avoid Extra Fees: If you can pay 20% upfront, you won’t have to pay for private mortgage insurance (PMI), which is an extra fee that protects the lender.

- Lower Monthly Payments: A larger down payment means you’ll borrow less money, which will lower your monthly mortgage payments.

- Better Loan Terms: Lenders may offer you better interest rates or loan terms if you can put down 20%.

- Cons:

- Longer Time to Save: Saving 20% of the home price can take a long time, especially with rising home costs.

- Missed Opportunities: Waiting too long to save up could mean missing out on good homes or low interest rates.

Saving for a Smaller Down Payment:

- Lower Upfront Costs: If 20% is too high for you, many loans allow for smaller down payments. For sample, FHA loans might demand as slight as 3.5%.

- Higher Monthly Payments: A smaller down payment means you’ll need to borrow more, which increases your monthly mortgage payment.

- Private Mortgage Insurance (PMI): If you put down less than 20%, you’ll likely have to pay PMI, which adds to your monthly costs.

By weighing the pros and cons, you can decide whether saving for a larger down payment is worth it or if a smaller one makes sense for your situation.

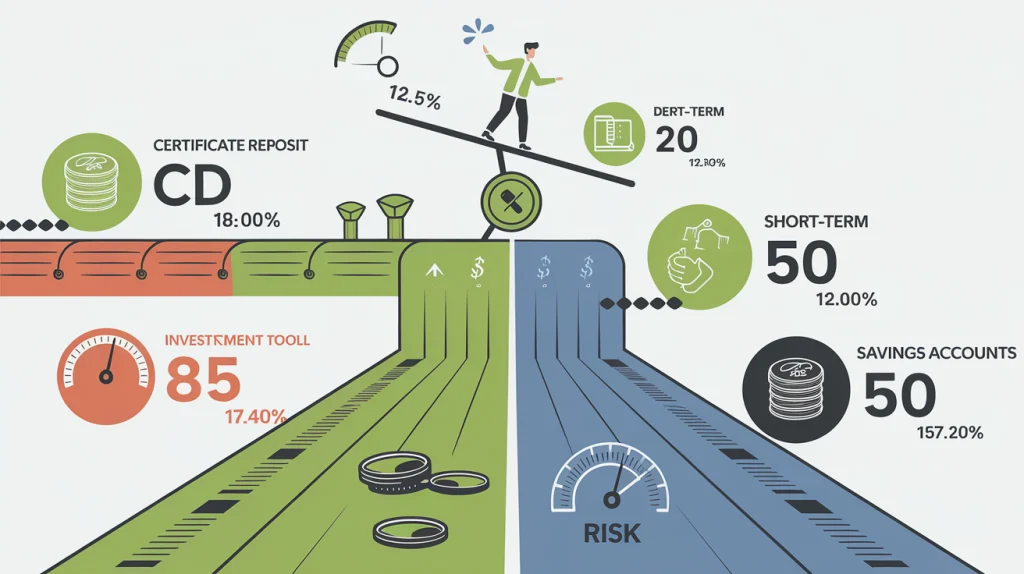

Boosting Your Savings with Investments

If you’re looking to grow your savings faster, investing can be a smart option. While traditional savings accounts are safe, investments can offer higher returns. But remember, investments come with risks, so it’s important to balance your choices.

Short-Term Investment Options

- Certificates of Deposit (CDs): CDs are a safe option where you deposit money for a fixed time, like 6 months or a year, and earn a higher interest rate than a regular savings account.

- Short-Term Bonds: Bonds are loans you give to the government or companies. Short-term bonds typically last a few years and can provide a steady return.

- Finances Market Funds: These accounts invest in short-term, low-risk stakes. They offer slightly higher returns than savings accounts with low risk.

Balancing Risk and Reward

- Low-Risk Investments: Stick with low-risk options like CDs or government bonds if you’re saving for a home in the next few years. These options protect your money while offering modest returns.

- Avoid High-Risk Investments: Avoid high-risk options like stocks if you need the money soon, as they can be volatile and unpredictable.

- Diversify Your Portfolio: Spread your investments across different types (CDs, bonds, savings) to reduce risk and ensure steady growth.

By boosting your savings with low-risk investments, you can grow your house fund faster while keeping your money safe.

Tracking Your Savings

Staying on top of your savings is key to reaching your goal of buying a house. Tracking your progress can help you stay motivated and make adjustments to your plan when needed.

Best Apps for Tracking and Milestones

- Mint: Mint helps you create budgets, track your spending, and set savings goals. It’s easy to use and provides a clear view of your finances in one place.

- You Need a Budget (YNAB): YNAB focuses on giving every dollar a job, helping you plan where your money goes. It’s great for setting up savings goals and tracking your progress.

- PocketGuard: This app shows how much money you have left after bills, making it easier to know what you can save.

These apps allow you to set milestones, like saving your first $5,000 or reaching your down payment goal, keeping you motivated as you work towards buying your house.

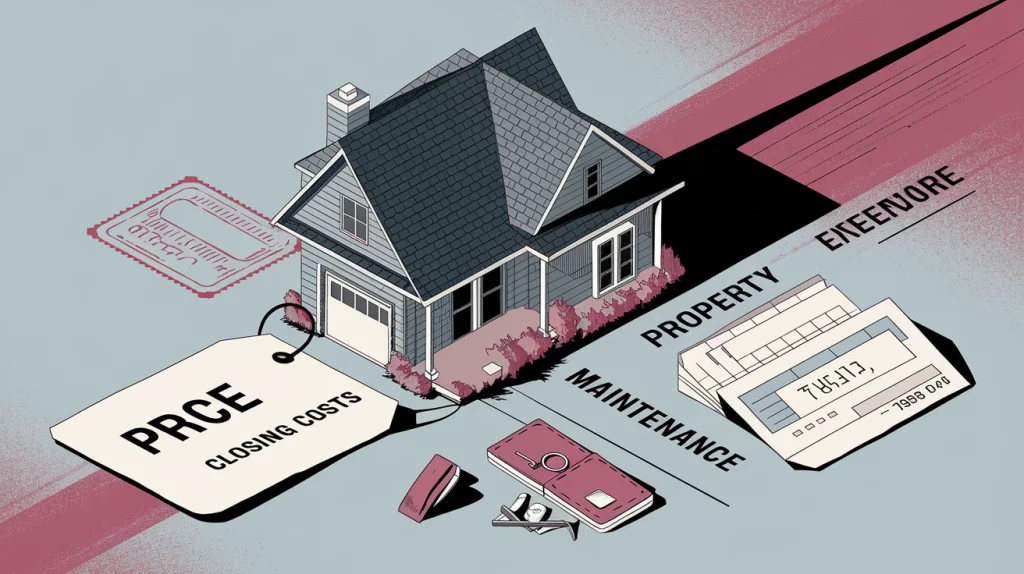

Hidden Homebuying Costs

When buying a home, there are more costs to consider beyond the purchase price. Knowing about these hidden costs helps you plan better and avoid surprises.

Closing Costs and Maintenance

- Closing Costs: These are fees you pay when finalizing your home purchase. They generally vary from 2% to 5% of the home’s expense. For example, if your house costs $300,000, you might need $6,000 to $15,000 for closing costs. This covers things like the home inspection, appraisal, and loan fees.

- Maintenance: Once you own the home, you’ll need to budget for maintenance and repairs. This includes things like fixing leaks, servicing your HVAC system, and general upkeep. Setting aside money for these tasks ensures your home stays in good shape.

Post-Purchase Expenses

- Property Taxes: You will need to pay property taxes each year based on the value of your home. These taxes help fund local services like schools and roads.

- Insurance: Homeowners insurance protects your home and belongings from damage or theft. It’s important to have adequate coverage in case of emergencies.

- Utility Bills: Expect to pay for utilities such as electricity, water, gas, and trash removal. These bills can add up, so it’s wise to include them in your budget.

Planning for these additional costs helps you manage your finances better and ensures you’re prepared for all the expenses that come with homeownership.

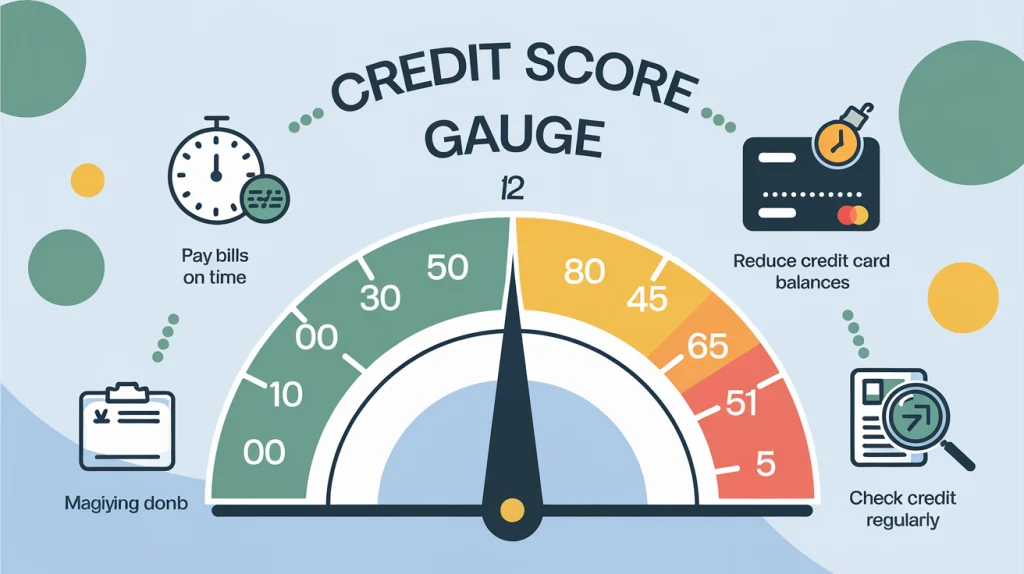

Improving Your Credit Score

Your credit score plays a big part in bringing a good mortgage rate. A higher score means you might qualify for better rates, which can save you money. Here’s how to improve your credit score:

Tips for Boosting Your Score for Better Rates

- Pay Your Bills on Time: Always make sure to pay your bills by their due dates. Late expenditures can damage your credit score.

- Lower Your Credit Card Balances: Try to maintain your credit card balances down. High balances can lower your score. Aim to utilize less than 30% of your general credit.

- Check Your Credit Report Regularly: Review your credit report to spot any errors or inaccuracies. You can get a free report once a year from each of the three major credit bureaus: Equifax, Experian, and TransUnion. Correcting mistakes can improve your score.

By following these tips, you can boost your credit score and increase your chances of getting a better mortgage rate and along with this you can find this read helpful if you wanna Save Money On Groceries.

Avoiding Common Saving Mistakes

When saving for a house, it’s important to avoid common mistakes that can slow down your progress or make your saving efforts less effective. Here’s what to watch out for:

Key Pitfalls to Avoid

| Keys to Avoid | Explanation |

|---|---|

| Don’t Dip into Your Savings | Only use your savings for your home purchase. Avoid spending this money on other expenses unless necessary. |

| Avoid New Debt | Taking on new loans or credit card debt can hinder your savings. Focus on paying off existing debt instead. |

| Spending Too Much on Unnecessary Items | Stick to your budget and avoid impulse purchases to maximize your savings. |

| Not Tracking Your Progress | Regularly monitor your savings using apps or a savings journal to stay motivated and on track. |

| Ignoring Hidden Costs | Save for additional costs like closing fees, home maintenance, and future repairs beyond the down payment. |

| Dipping Into Your Savings | Resist using your house savings for non-home expenses. Keep this money separate to avoid setbacks. |

| Not Adjusting Your Plan | If your financial situation changes, update your savings plan. For instance, save more if you get a raise. |

By avoiding these mistakes, you can make your saving efforts more effective and reach your goal of buying a house sooner.

By steering clear of these pitfalls, you can stay on track and make steady progress towards your goal of buying a home.

Alternative Ways to Save

If you want to speed up your savings for a house, exploring additional income sources can be very helpful. Here are some helpful ways to make extra cash-on-hand:

Side Hustles, Freelancing, and Extra Income Ideas

- Freelancing: Use talents you already have to carry on freelance work. You can offer services like writing, graphic design, or programming on platforms such as Upwork or Fiverr.

- Part-Time Jobs: Consider getting a part-time job in your spare time. Retail, food service, or customer service jobs can provide extra income.

- Gig Economy Jobs: Join the gig economy by driving for ride-sharing services like Uber or Lyft, or delivering food with apps like DoorDash or Grubhub.

- Online Surveys and Market Research: Participate in online surveys or focus groups to earn extra cash. Websites like Swagbucks or Survey Junkie offer rewards for your opinions.

- Selling Unused Items: Clean out your home and sell items you no longer need on platforms like eBay, Facebook Marketplace, or Craigslist.

- Tutoring or Teaching: If you have expertise in a subject, offer tutoring or teach classes online. Websites like Tutor.com or Teachable can help you get started.

By using these alternative ways to save, you can increase your income and put more money toward your home purchase, helping you reach your savings goal faster.

Final Steps: Are You Ready?

Before you buy a house, it’s important to make sure you’re fully prepared. Here are the key financial milestones to check off:

Key Financial Milestones Before Buying

- Down Payment and Closing Costs: Ensure you have enough savings for the down payment and closing costs. The down payment is typically 10-20% of the home’s price, and closing costs can be 2-5% of the home’s price. It’s crucial to have this money set aside to avoid delays in your home purchase.

- Good Credit Score: Check your credit score and work on improving it if needed. A higher credit score can help you get better mortgage rates and make the buying process smoother. Make sure your credit report is clean, with no missed payments or high credit card balances.

- Budget for Ongoing Home Expenses: Prepare for ongoing costs such as property taxes, homeowners insurance, utilities, and maintenance. Having a budget for these expenses will help you manage your finances better and avoid any surprises after moving into your new home.

Reference Links

| Topic | Description | Wikipedia Link |

|---|---|---|

| Savings and Loan Association | Detailed explanation of savings and loan institutions, their history, and regulations affecting them. | Savings and Loan Association |

| History of Banking | An overview of the evolution of banking, including the rise of various savings institutions. | History of Banking |

| Federal Home Loan Bank Act | Information on the Federal Home Loan Bank Act and its role in supporting home loans and savings institutions. | Federal Home Loan Bank Act |

| FHA Loans (Federal Housing Administration) | History and function of the FHA, providing mortgage insurance and assistance to homebuyers. | Federal Housing Administration |

| VA Loans (Veterans Affairs Loans) | Overview of VA Loans, offering no-down-payment home loans for veterans and military members. | VA Loan |

Recap and Final Tips for Success

Saving for a house might seem challenging, but with a good plan and some determination, you can make it happen. Here’s a quick recap of the steps to get you on the right track:

| Step | Description |

|---|---|

| Set Clear Goals | Determine the total amount needed for down payment and other costs. Break it into smaller goals. |

| Choose the Right Savings Accounts | Opt for high-yield savings or money market accounts. Compare options for the best return. |

| Explore Government Assistance | Look into FHA, VA, and USDA loans to reduce your down payment and make buying more affordable. |

| Decide on Your Down Payment | Choose between a 20% down payment or a smaller amount. Consider the impact on monthly payments. |

| Boost Your Savings with Investments | Consider safe investments like CDs or short-term bonds to grow your savings faster. |

| Track Your Progress | Use apps to monitor savings and keep motivated. Track milestones to see your progress. |

| Plan for Hidden Costs | Budget for closing costs and ongoing home expenses to avoid surprises. |

| Improve Your Credit Score | Raise your credit score by paying bills on time and reducing credit card balances. |

| Avoid Common Mistakes | Be aware of common saving pitfalls and avoid them to stay on track. |

| Consider Extra Income | Explore side hustles or freelance work to increase your savings. |